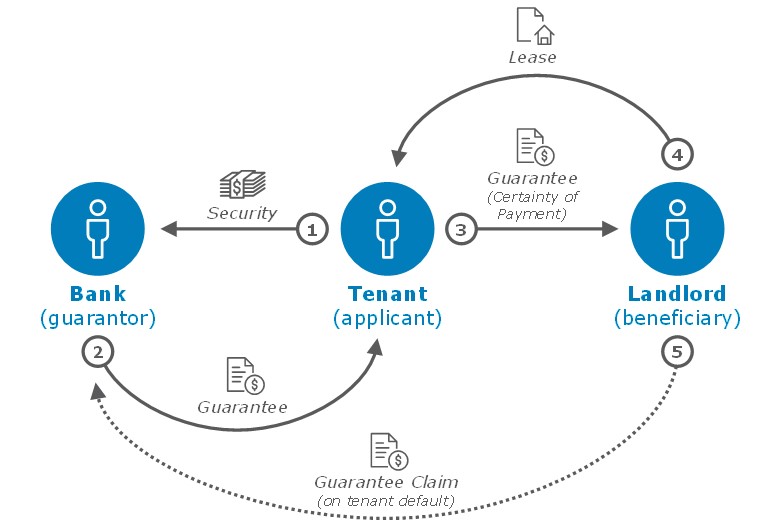

Bank Guarantee Process

A bank guarantee is a formal assurance from the bank which makes sure that the liabilities of a debtor will be met.

Bank guarantee process. This concept is known as bank guarantee bg. A bank guarantee is a banks promise that liabilities of a debtor will be met if he does not fulfi l contractual obligations. The applicant needs to apply to the bank to provide a guarantee for the loan taken from the creditor. In other words if the debtor fails to settle a debt the bank covers.

When a bank signs a bank guarantee it promises to pay any amount according to the request made by the borrower. In such a case the bank will pay the. The process of issuing a bank guarantee is hassle free if the credential of business is appropriate hence increase the business opportunities globally. A performance guarantee kicks in if services or goods are not provided to the buyer by the seller as per the specifi cations mentioned in the contract.

Bank guarantee can be claimed only when the seller has performed his part of the contract and the issuing banks client buyer has failed to make the paymentin other words it is always the obligation of the buyer to pay for the purchaseborrowing and only if he is unable to make the payment on the date of payment the bank guarantee can be put to use. The bank guaranty facility is not only for business organisations but also. A bank guarantee is a guarantee from a lending institution ensuring the liabilities of a debtor will be met. Understand the process of bank guarantee.

A bank guarantee empowers the debtor to acquire assets or draw loans in orders to expand their business activity. This tutorial explains what is sap bank guarantees and sap bank guarantees process. First the applicant will apply for a loan from the beneficiary or a creditor. First an applicant will ask for a loan from a beneficiary or creditor.

In such circumstances approach your bank and ask it to stand as a guarantor on your behalf. A bid bond guarantee ensures that the winning bidder of a project accepts and executes it as per contract. This is usually seen when a small company is dealing with much larger entity or even a government across borderlet us take an example of a company xyz bags a project from say the government of ethiopia to build 200 power transmission towers. Board resolution for private limited companylimited company.

These 2 parties have to comply to apply for bank guarantee.

/how-letters-of-credit-work-315201-final-5b51ed66c9e77c0037974e85.png)