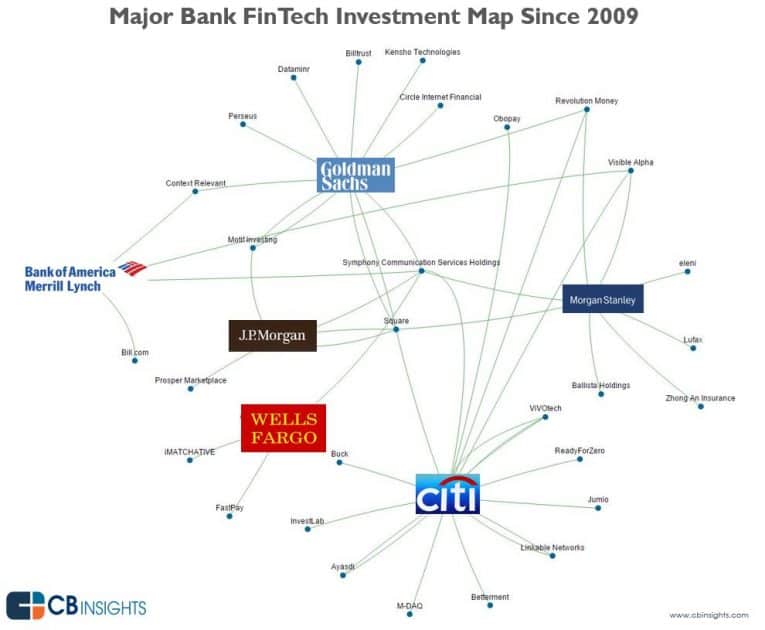

Banks Investing In Fintech

This is across categories like blockchain insurance and lending.

Banks investing in fintech. Banks are ramping up investments in some of their potential competitors. Research company cb insights analysed the private market fintech investment activity of the top european banks and their venture arms by assets under management aum from 2012 to q2 2018 as of 11 april 2018. The investing trading and wealth management firms on forbes fintech 50 2019 offer more than just the services once exclusive to big banks and traditional financial firms. Capitec is listed on the south african stock exchange and is the parent company of capitec bank.

Us banks are future proofing by actively investing in fintech startups. For example creamfinance europes fastest growing fintech just secured a 21 million deal in series b financing from capitec bank holdings limited capitec. Banks are investing in fintech. According to the graphic below created by cb insights european banks are placing strategic bets across wealth management lending payments and regulatory technology and also.

So far this year major wall street banks have participated in 24 fintech equity deals according to cb. The combination of their wealth and resources with the strategic limitations of fintech startups means that banks still have time to prevent their industry from facing widespread disruption. While investment activity dropped on a quarterly basis in q1 2017 four of the last five quarters have seen over 1 billion invested into fintech start ups in the us backed by venture capital firms. This follows a record 2018 where us banks backed 45 equity deals to fintech startups a 180 increase from 2017.

Q219 fintech funding topped 83b boosted by a record quarter of 100m mega rounds. New fintech departments created in banks raise the demand for specialists with skills and expertise in both finance and development. Since 2012 the top ten us banks by assets under management have participated in 72 rounds totaling 36 billion to 56 fintech companies according to cb insights. Banks investing in fintech startups is also becoming a global phenomenon.

Download the free report for all the details. As a result a lot of innovative positions for cybersecurity analysts product managers compliance experts data specialists have flooded the labour market. In 2019 ytd us banks have participated in 24 equity deals to fintech companies. A new market analysis report maps out how the top ten us.

Only 7 of banks have set up their own fintech labs. The majority 63 have preferred a passive approach of investing in startups or setting up their own fintech accelerators.