Nsf Check Bank Reconciliation Journal Entries

Examples of journal entries for bank reconciliation.

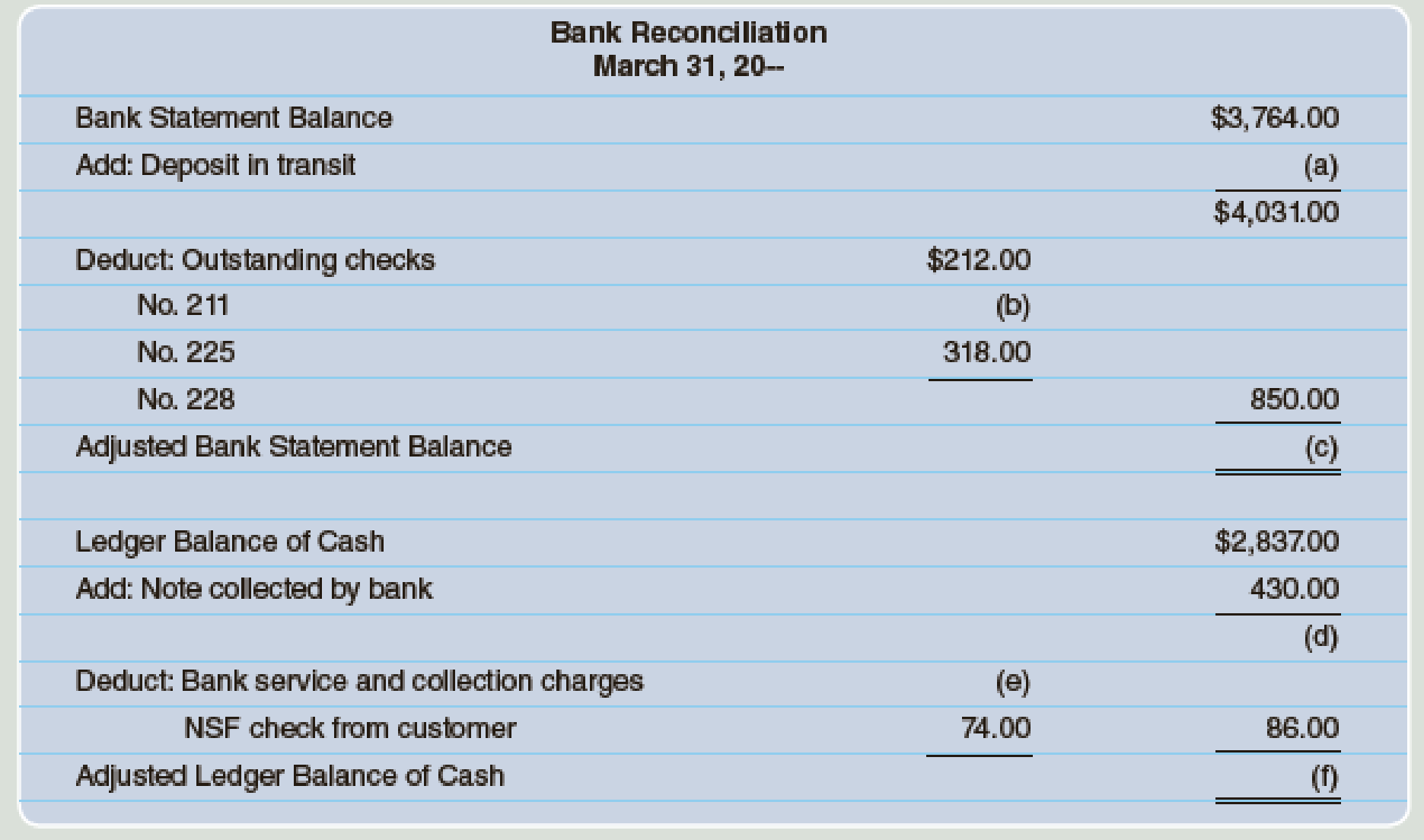

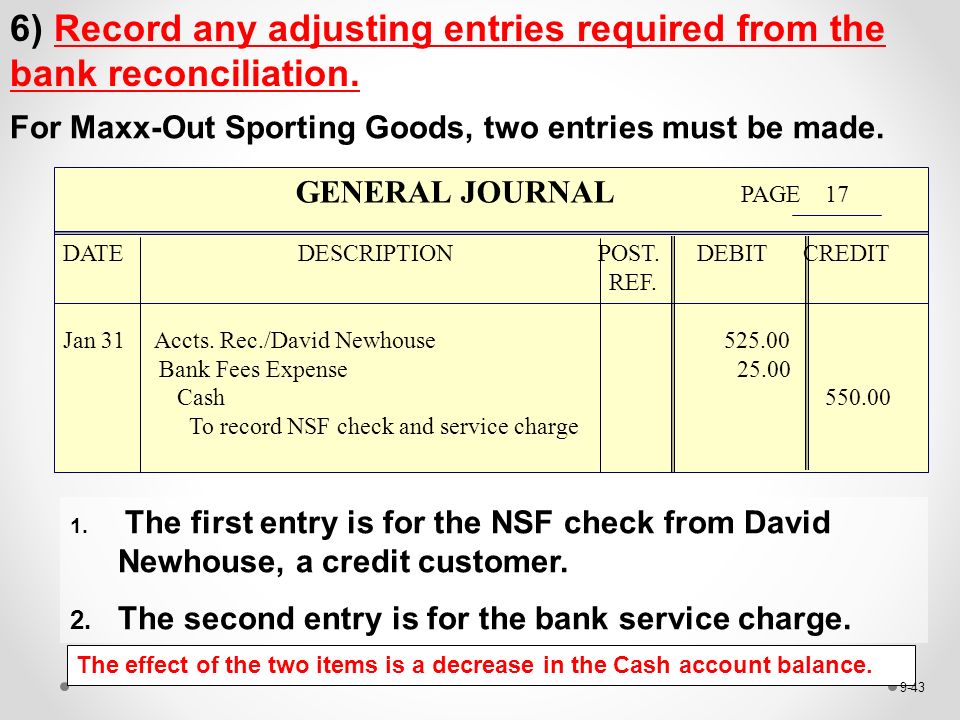

Nsf check bank reconciliation journal entries. The correct journal entry to reconcile the interest earned on a bank balance is. Since the service charge is on the bank statement but not yet on the companys books a journal entry is needed to credit cash and to debit an expense such as bank. The bank reconciliation journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting relating to bank reconciliation adjustments. Adjusting the balance per bank.

Hawk management ltd year ending financial statements shows the below following entries. The business sends the check to the bank for payment but due to lack of funds on the checking account of the customer the bank does not honor the check and returns it. Examples of items requiring a journal entry as the result of the bank reconciliation include. The first step is to adjust the balance on the bank statement to the true adjusted or corrected balance.

What is the correct journal entry for recording the nsf ck and the bank charges to balance the bank statment. The items necessary for this step are listed in the following schedule. We will assume that a company has the following items. 16 bank reconciliation statement nsf check also know about non sufficient check not sufficient fund the checks which are received from debtors and deposited in the bank by the company but returned by the bank as being less or non sufficient fund nsf in debtors account are called nsf check.

Bank reconciliation with journal entries duration. Correct journal entry for nsf check and accounts receivable. We will demonstrate the bank reconciliation process in several steps. Sample bank reconciliation with amounts.

Bank reconciliation process step 1. Find the net realisable value of accounts receivable. You credit cash for the amount that was deducted from your. The bank statement for august 2019 shows an ending balance of 3490.

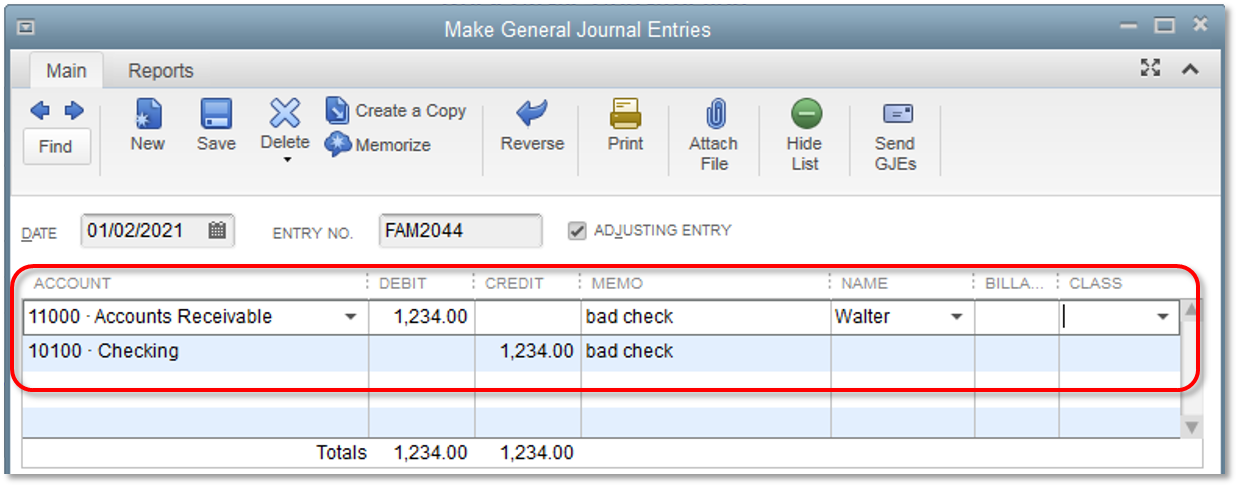

Learn how to journalize the entries required at the end of a bank reconciliation. Pu 2015 spring q. The correct journal entry to reconcile an nsf check returned by the bank is. Posted entry to ar and cash.

Bank service charges which are often shown on the last day of the bank statement. In each case the bank reconciliation journal entries show the debit and credit account together with a brief narrative. Nsf check journal entry. In making journal entries to assign raw materials costs a company using process costing.

Click here to see the original bank reconciliation video. In this part we will provide you with a sample bank reconciliation including the required journal entries. I received a ck from customer. On august 31 the bank statement shows charges of 35 for the service charge for maintaining the checking.

Bank reconciliation statement correcting check errors nsf checks on cash balance duration.