Open Banking Architecture Pdf

Implementing a successful open banking architecture is critical for a bank to fully leverage the benefits of open banking.

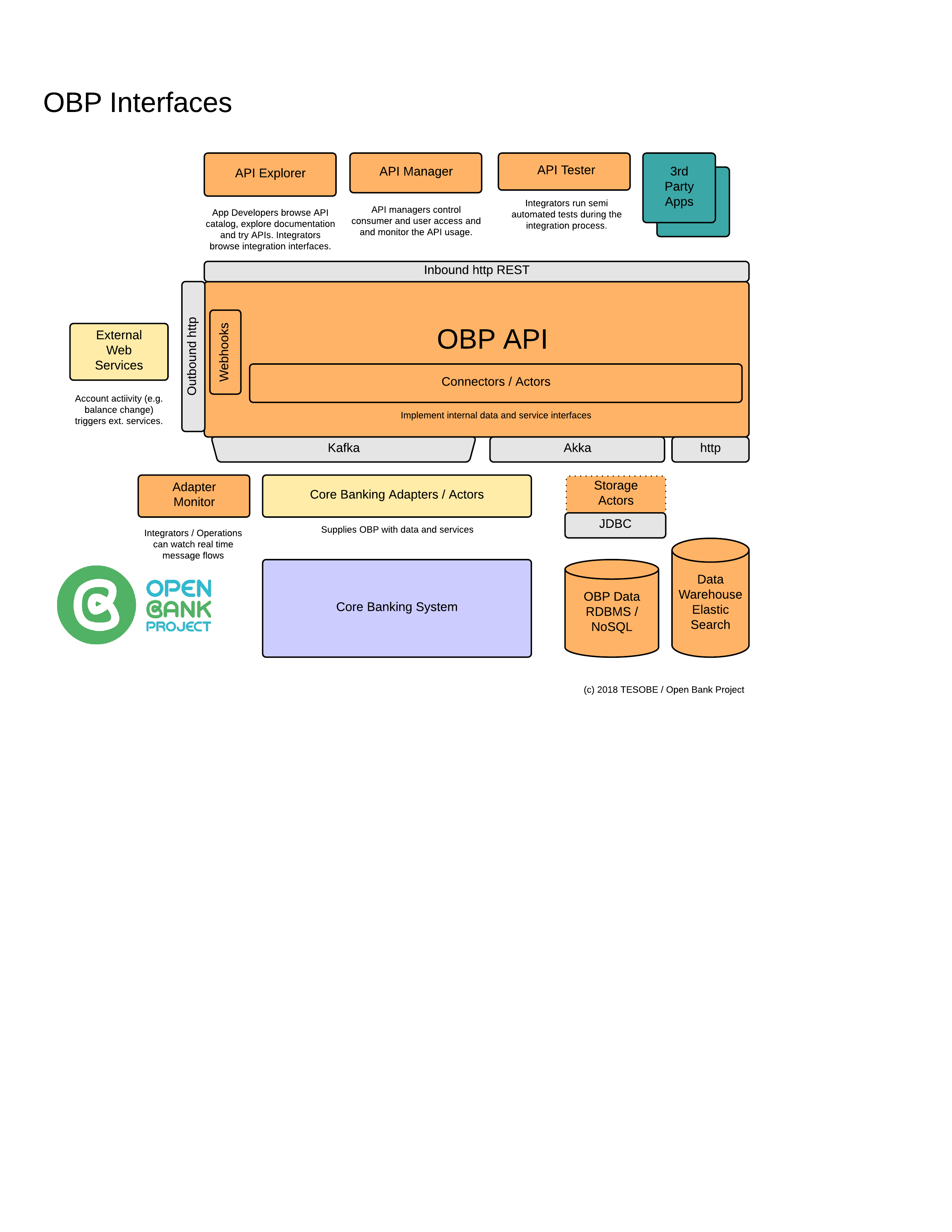

Open banking architecture pdf. To identify what the key requirements of an open banking platform are and how they can be implemented selecting the right technology is a top priority. Figure 10 data governance architecture as a critical enabler data denition data acquisition data. Customer transaction data data that is presented to customers in their financial statements including underlying transaction history and data that relates to a customer. It leverages five key technology areas critical to a banking infrastructureapi management identity and access management integration analytics and business insights and fraud detection bundled together to form a componentized architecture.

Wso2 open banking was built by considering the standards and specifications that different regions and banks have. Wso2 open banking supports a technology stack that banks need in order to become psd2 compliant and digitally transformed. Transformation through soa service. 1 define api reference architecture.

This echoes the design of the web itself and enables far greater scope for innovation. Modern core banking solutions bring the ability to create innovative products and services rapidly and this transformation is imperative to remain competitive. Data governance and architecture is a tightrope that organisations in the banking sector must navigate to realise the upside of unlocking information silos and to protect themselves from potential threats in an open banking environment. Open banking readiness approach to help organisations get up and running with open banking and a response to the exploding api economy we have a range of offerings which focus on both business strategy and proposition design through to technology implementation.

In another study on key focus areas for transformation 47 of respondents stated core banking systems transformation as their topmost priority see exhibit 5.